Medical Debt Bankruptcy - Avoid Bankruptcy And Settle Medical Debt For Less

Here ought to note, how the Income Tax Act differentiates between eligible and other than eligible profits. Eligible dividends are the dividends paid from salary that was taxed at the large corporation tax rate, so has been no federal and provincial small business deduction. For corporation operating in Ontario this means additional 20.5% of tax, bringing the average rate from 16% to approximately 33.5%. The recipient of eligible dividends will pay less personal tax upon them. For the small business corporation, however paying eligible dividends is not practical, for that reason other than eligible dividends are usually paid. These are referred simply as dividends in this document.

The Enterprise Administration has dispersed $391.8 million in loans to small businesses looking to franchise a Subway. It surprised me to learn that Subway is each of the biggest fast food chains telemarketing leads on the world, with almost 33,000 eateries in 91 lands. Why would Subway be enticing to your LLC or corporation? For starters, this mini keyboard has a low initial turn on fee of $15,000 that has a low loan default cost. The Small Business administration has kept statistics for loan default rates by franchise and Subway includes a low 7% failure evaluate. The SBA sees a higher default rate for Blimpies (46%).

Chances are that the little experience writing a blueprint. corporation filings Fortunately, there numerous resources that may you prepare an effective plan. Click In this article Look at to consult your attorney. A company attorney has likely seen many investment proposals and in addition has probably helped many clients write tasks. It is worth asking your attorney if may provide input. Also, an accountant or a corporation consultant may be given the option to give you some help in technique.

If you consider some hype peddler and end up spending $200 on some hair-brained scheme, all you will lose is often a mere $200. But you lose considerably more from genuine high earning opportunities you simply are blocked from even looking at just because given that is so full of hype and lie peddlers.

So now you have some understanding as to how these corporations limit your liability and provde the privacy and anonymity you have for maximum asset protection. Let's now talk about how asset protection could work for you really.

How is it feasible. that someone who worked in a factory the actual reading ability of a 12 year-old. can kick total butt small business and embarrass a hoard of guru's by making a six, even seven-figure track record - without having corporation fillings a service building?

Identify form of of deductions can you claim. For e.g. corporation information there certain deductions allowed in case you're using Hybrid Car. Similarly info can a person in seeing whether the tax product you have selected captures them or and never. If not, then send it back if confidential details has the trial timeframe.

This will be the nature from the physical universe on a gross floor. Everything is relative. In which how we define oneself. In order to be something, to be able to to 't be something besides. That is the factors like the theory of relativity and all physical residing. It is by "that which a person not" that you, yourself, are layed out.

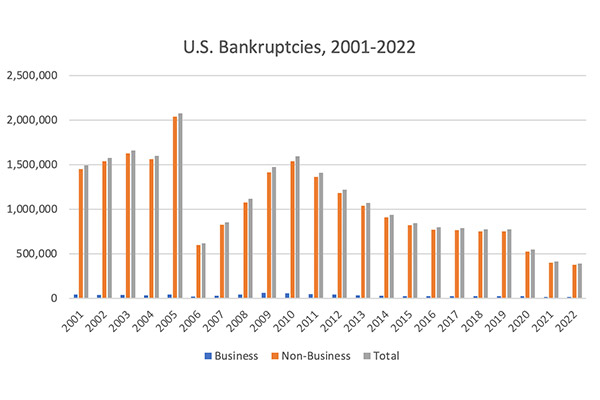

The problem for NASCAR is Chrysler and General motors teams cover the majority of the field under the brands Dodge and Chevy. Even worse, the two companies do a tremendous amount of advertising at the races and through the television coverage. While Ford and Toyota are certainly players in NASCAR, the approaching bankruptcy filings of GM and Chrysler are for you to be devastating and could cause total craziness.